Morning Bell: Waxman-Markey an Energy Tax That Doesn’t Work

Posted June 26th, 2009 at 8.42am in Energy and Environment.

Later today, the House of Representatives is slated to vote on the most convoluted attempt at economic central-planning this nation has ever attempted: cap and trade. The 1,200-plus page Waxman-Markey climate change legislation is nothing more than an energy tax in disguise that by 2035 will raise:

Although proponents of the bill are pointing to grossly underestimated and incorrect costs, the reality is when all the tax impacts have been added up, the average per-family-of-four costs rise by $2,979 per year. In the year 2035 alone, the cost is $4,609. And the costs per family for the whole energy tax aggregated from 2012 to 2035 are $71,493.

But on second thought, cap and trade is much more than that.

It Kills Jobs: Over the 2012-2035 timeline, job losses average over 1.1 million. By 2035, a projected 2.5 million jobs are lost below the baseline (without a cap and trade bill). Particularly hard-hit are sectors of the economy that are very energy-intensive: Manufacturers, farmers, construction, machinery, electrical equipment and appliances, transportation, textiles, paper products, chemicals, plastics and rubbers, and retail trade would face staggering employment losses as a result of Waxman-Markey. It’s worth noting the job losses come after accounting for the green jobs policymakers are so adamant about creating. But don’t worry, because the architects of the bill built in unemployment insurance; too bad it will only help 1.5% of those losing their jobs from the bill.

It Destroys Our Economy: Just about everything we do and produce uses energy. As energy prices increase, those costs will be passed onto the consumer and reflected in the higher prices we pay for products. Higher energy prices will cause reduced income, less production, and an economy that falls way short of its potential. The average Gross Domestic Product (GDP) lost is $393 billion, hitting a high of $662 billion in 2035. From 2012-2035, the accumulated GDP lost is $9.4 trillion. The negative economic impacts accumulate, and the national debt is no exception. The increase in family-of-four debt, solely because of Waxman-Markey, hits an almost unbelievable $114,915 by 2035.

It Provides Red Meat for Lobbyists: Businesses, knowing very well this would impose a severe cost on their bottom line, sent their lobbyists to Washington to protect them. And it worked. Most of the allowances (the right to emit carbon dioxide) have been promised to industry, meaning less money will be rebated back to the consumer. Free allowances do not lower the costs of Waxman-Markey; they just shift them around. In other words, everyday Americans are going to be footing the bill. Although the government awarded handouts to businesses, the carbon dioxide reduction targets are still there, and the way they will be met is by raising the price of energy and thereby inflicting more economic pain. Prices have to go up enough to force people to use less energy, and so if anyone is bought off with free allowances, the costs for everyone else are that much higher.

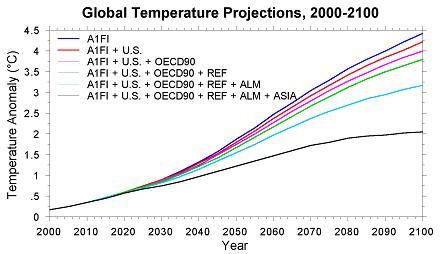

There’s one thing the Waxman-Markey cap and trade bill doesn’t do: Work. All of the above-mentioned costs accrue in the first 25 years of a 90-year program that, as calculated by climatologists, will lower temperatures by only hundredths of a degree Celsius in 2050 and no more than two-tenths of a degree Celsius at the end of the century. In the name of saving the planet for future generations, Waxman-Markey does not sound like a great deal: millions of lost jobs, trillions of lost income, 50-90 percent higher energy prices, and stunning increases in the national debt, all for undetectable changes in world temperature. Who’s buying that?

http://blog.heritage.org/2009/06/26...arkey-bill-is-an-energy-tax-that-doesnt-work/

Posted June 26th, 2009 at 8.42am in Energy and Environment.

Later today, the House of Representatives is slated to vote on the most convoluted attempt at economic central-planning this nation has ever attempted: cap and trade. The 1,200-plus page Waxman-Markey climate change legislation is nothing more than an energy tax in disguise that by 2035 will raise:

- Gasoline prices by 58 percent

- Natural gas prices by 55 percent

- Home heating oil by 56 percent

- Worst of all, electricity prices by 90 percent

Although proponents of the bill are pointing to grossly underestimated and incorrect costs, the reality is when all the tax impacts have been added up, the average per-family-of-four costs rise by $2,979 per year. In the year 2035 alone, the cost is $4,609. And the costs per family for the whole energy tax aggregated from 2012 to 2035 are $71,493.

But on second thought, cap and trade is much more than that.

It Kills Jobs: Over the 2012-2035 timeline, job losses average over 1.1 million. By 2035, a projected 2.5 million jobs are lost below the baseline (without a cap and trade bill). Particularly hard-hit are sectors of the economy that are very energy-intensive: Manufacturers, farmers, construction, machinery, electrical equipment and appliances, transportation, textiles, paper products, chemicals, plastics and rubbers, and retail trade would face staggering employment losses as a result of Waxman-Markey. It’s worth noting the job losses come after accounting for the green jobs policymakers are so adamant about creating. But don’t worry, because the architects of the bill built in unemployment insurance; too bad it will only help 1.5% of those losing their jobs from the bill.

It Destroys Our Economy: Just about everything we do and produce uses energy. As energy prices increase, those costs will be passed onto the consumer and reflected in the higher prices we pay for products. Higher energy prices will cause reduced income, less production, and an economy that falls way short of its potential. The average Gross Domestic Product (GDP) lost is $393 billion, hitting a high of $662 billion in 2035. From 2012-2035, the accumulated GDP lost is $9.4 trillion. The negative economic impacts accumulate, and the national debt is no exception. The increase in family-of-four debt, solely because of Waxman-Markey, hits an almost unbelievable $114,915 by 2035.

It Provides Red Meat for Lobbyists: Businesses, knowing very well this would impose a severe cost on their bottom line, sent their lobbyists to Washington to protect them. And it worked. Most of the allowances (the right to emit carbon dioxide) have been promised to industry, meaning less money will be rebated back to the consumer. Free allowances do not lower the costs of Waxman-Markey; they just shift them around. In other words, everyday Americans are going to be footing the bill. Although the government awarded handouts to businesses, the carbon dioxide reduction targets are still there, and the way they will be met is by raising the price of energy and thereby inflicting more economic pain. Prices have to go up enough to force people to use less energy, and so if anyone is bought off with free allowances, the costs for everyone else are that much higher.

There’s one thing the Waxman-Markey cap and trade bill doesn’t do: Work. All of the above-mentioned costs accrue in the first 25 years of a 90-year program that, as calculated by climatologists, will lower temperatures by only hundredths of a degree Celsius in 2050 and no more than two-tenths of a degree Celsius at the end of the century. In the name of saving the planet for future generations, Waxman-Markey does not sound like a great deal: millions of lost jobs, trillions of lost income, 50-90 percent higher energy prices, and stunning increases in the national debt, all for undetectable changes in world temperature. Who’s buying that?

http://blog.heritage.org/2009/06/26...arkey-bill-is-an-energy-tax-that-doesnt-work/