Twitter IPO / Who Buyin?

- Thread starter StillHustlin

- Start date

THe housing crash was caused by Billy Clinton who had Freddie and Fannie relax their underwriting criteria which fueled demand from unqualified borrowers. "Everyone should own a home" - LOL.

Under Clinton’s Housing and Urban Development (HUD) secretary, Andrew Cuomo, Community Reinvestment Act regulators gave banks higher ratings for home loans made in ‘credit-deprived’ areas. Banks were effectively rewarded for throwing out sound underwriting standards and writing loans to those who were at high risk of defaulting.

What’s more, in the Clinton push to issue home loans to lower income borrowers, Fannie Mae and Freddie Mac made a common practice to virtually end credit documentation, low credit scores were disregarded, and income and job history was also thrown aside. The phrase “subprime” became commonplace. What an understatement. … Tragically, when prices fell, lower-income folks who really could not afford these mortgages under normal credit standards, suffered massive foreclosures and personal bankruptcies.

For the most part, the lack of qualified borrowers are now absent as Banks tightened lending standards. Also, lenders learned from the last down turn and are now not as quick to start the foreclosure process and instead work with borrowers on forbearance agreements, deferrals, etc. Thus not adding to supply.

With people FLEEING big urban centers (who wants to be lock downed in a 700sqft apartment with no restaurants and places to go paying $3,000/mo) - single family homes are BOOMING especially in secondary markets and with all the money sloshing around in the markets, prices for homes aint going down anytime soon.

Under Clinton’s Housing and Urban Development (HUD) secretary, Andrew Cuomo, Community Reinvestment Act regulators gave banks higher ratings for home loans made in ‘credit-deprived’ areas. Banks were effectively rewarded for throwing out sound underwriting standards and writing loans to those who were at high risk of defaulting.

What’s more, in the Clinton push to issue home loans to lower income borrowers, Fannie Mae and Freddie Mac made a common practice to virtually end credit documentation, low credit scores were disregarded, and income and job history was also thrown aside. The phrase “subprime” became commonplace. What an understatement. … Tragically, when prices fell, lower-income folks who really could not afford these mortgages under normal credit standards, suffered massive foreclosures and personal bankruptcies.

For the most part, the lack of qualified borrowers are now absent as Banks tightened lending standards. Also, lenders learned from the last down turn and are now not as quick to start the foreclosure process and instead work with borrowers on forbearance agreements, deferrals, etc. Thus not adding to supply.

With people FLEEING big urban centers (who wants to be lock downed in a 700sqft apartment with no restaurants and places to go paying $3,000/mo) - single family homes are BOOMING especially in secondary markets and with all the money sloshing around in the markets, prices for homes aint going down anytime soon.

ive been sleeping on this thread. Anybody ivest in Pfizer. Gotta come up on the coronavirus cure.

Props:

StillHustlin

I guess method man could explain

Attachments

-

231.6 KB Views: 2

Props:

StillHustlin

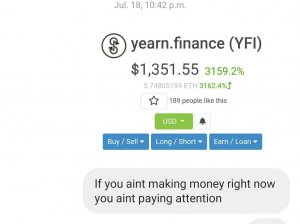

Deriswap and defi

$sushi $yfi $cream $aave $k3pr $akro $snx

The last bull run was all about eth killers/privacy coins/utility coins

Yall watch defi/oracles

Just watch

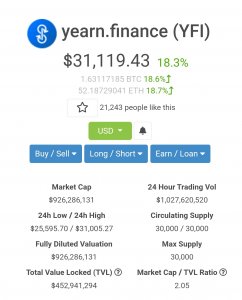

$sushi $yfi $cream $aave $k3pr $akro $snx

The last bull run was all about eth killers/privacy coins/utility coins

Yall watch defi/oracles

Just watch

Attachments

-

241.3 KB Views: 3

Props:

StillHustlin