Twitter IPO / Who Buyin?

- Thread starter StillHustlin

- Start date

Salesforce still mulls bid for Twitter as shareholders resist: sources

By Greg Roumeliotis and Liana B. Baker

(Reuters) - Salesforce.com Inc (CRM.N) is still deliberating whether it should make an offer for Twitter Inc (TWTR.N) in the face of resistance from Salesforce shareholders over the strategic merits and valuation of such a deal, people familiar with the matter said on Monday.

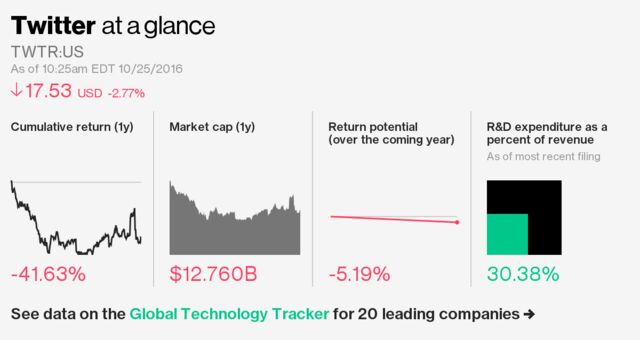

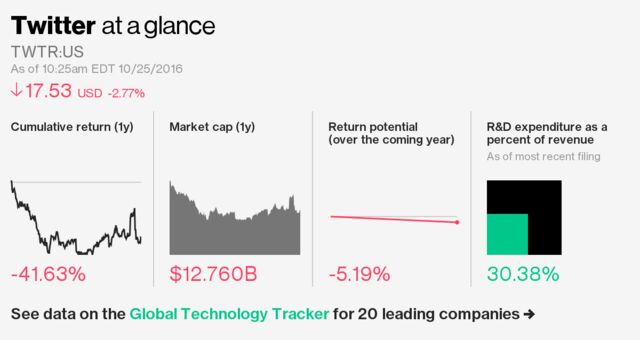

Twitter shares have lost as much as a third of their value since Oct. 5 on concerns the company has attracted less interest from potential acquirers than previously envisaged. It now has a market capitalization of $12 billion.

Salesforce is deliberating whether it is worth making a lowball offer for Twitter in the coming days based on Twitter's stock performance and any news of other bidders, the people said.

Other potential acquirers such as Alphabet Inc's Google (GOOGL.O) and Walt Disney Co (DIS.N) have backed away from making offers for the Internet company, the people said. There may however be other companies contemplating offers for Twitter whose identity has not yet been reported, some of the sources suggested.

The sources asked not to be identified because the deliberations are confidential. Salesforce declined to comment while Twitter, Google and Disney did not immediately respond to a request for comment.

Reuters previously reported that Twitter aimed to conclude deliberations about selling itself by Oct. 27, when it reports its third-quarter earnings.

Salesforce.com, run by CEO Marc Benioff, is focused on cloud-based sales and marketing software. Unlike Twitter, its main product is aimed at business users, not consumers. Under Salesforce.com, Twitter could become a corporate tool used to power sentiment analysis and nurture customer relationships.

A potential acquisition of Twitter has weighed down Salesforce's stock since news broke on Sept. 23 that it was vying for Twitter. Its shares rose as much as 7 percent on Monday after a weekend report by Bloomberg News suggested Salesforce was unlikely to make an offer.

Some analysts and investors have questioned why Salesforce would need to own Twitter, when it already licenses the Twitter "firehose" for its new artificial intelligence platform, Einstein.

At Salesforce's annual client conference last week, Benioff said Salesforce considers buying many companies but maintains discipline, and wished Twitter CEO Jack Dorsey "well." These comments tamped out expectations that Salesforce would be an aggressive bidder for Twitter.

Since its founding a decade ago, Twitter has struggled to generate revenue growth and profit, despite having some 313 million average monthly active users and a growing presence as a source of news.

========================================

CRM

10/10 CLOSE: UP 4.19/share to 75.10/share

EPS: 0.318

P/E: 228.476

BETA: 1.589

--------

Earnings per share (EPS) is the portion of a company's profit allocated to each outstanding share of common stock. Earnings per share serves as an indicator of a company's profitability.

Calculated as:

------

The price to earnings ratio (PE Ratio) is the measure of the share price relative to the annual net income earned by the firm per share. PE ratio shows current investor demand for a company share. A high PE ratio generally indicates increased demand because investors anticipate earnings growth in the future. The PE ratio has units of years, which can be interpreted as the number of years of earnings to pay back purchase price.

PE ratio is often referred to as the "multiple" because it demonstrates how much an investor is willing to pay for one dollar of earnings. PE Ratios are sometimes calculated using estimations of next year's earnings per share in the denominator. When this happens, it is usually noted.

For more information on evaluating valuation multiples similar to this, please see our original white paper research : Making Sense Of Valuation Multiples.

Formula

Price to Earnings Ratio = Price / Earnings Per Share (EPS)

(Note: YCharts uses the Trailing Twelve Months (TTM) sum of Net EPS Diluted in the denominator)

------

A beta of 1 indicates that the security's price moves with the market. A beta of less than 1 means that the security is theoretically less volatile than the market. A beta of greater than 1 indicates that the security's price is theoretically more volatile than the market. For example, if a stock's beta is 1.2, it's theoretically 20% more volatile than the market. Conversely, if an ETF's beta is 0.65, it is theoretically 35% less volatile than the market. Therefore, the fund's excess return is expected to underperform the benchmark by 35% in up markets and outperform by 35% during down markets.

By Greg Roumeliotis and Liana B. Baker

(Reuters) - Salesforce.com Inc (CRM.N) is still deliberating whether it should make an offer for Twitter Inc (TWTR.N) in the face of resistance from Salesforce shareholders over the strategic merits and valuation of such a deal, people familiar with the matter said on Monday.

Twitter shares have lost as much as a third of their value since Oct. 5 on concerns the company has attracted less interest from potential acquirers than previously envisaged. It now has a market capitalization of $12 billion.

Salesforce is deliberating whether it is worth making a lowball offer for Twitter in the coming days based on Twitter's stock performance and any news of other bidders, the people said.

Other potential acquirers such as Alphabet Inc's Google (GOOGL.O) and Walt Disney Co (DIS.N) have backed away from making offers for the Internet company, the people said. There may however be other companies contemplating offers for Twitter whose identity has not yet been reported, some of the sources suggested.

The sources asked not to be identified because the deliberations are confidential. Salesforce declined to comment while Twitter, Google and Disney did not immediately respond to a request for comment.

Reuters previously reported that Twitter aimed to conclude deliberations about selling itself by Oct. 27, when it reports its third-quarter earnings.

Salesforce.com, run by CEO Marc Benioff, is focused on cloud-based sales and marketing software. Unlike Twitter, its main product is aimed at business users, not consumers. Under Salesforce.com, Twitter could become a corporate tool used to power sentiment analysis and nurture customer relationships.

A potential acquisition of Twitter has weighed down Salesforce's stock since news broke on Sept. 23 that it was vying for Twitter. Its shares rose as much as 7 percent on Monday after a weekend report by Bloomberg News suggested Salesforce was unlikely to make an offer.

Some analysts and investors have questioned why Salesforce would need to own Twitter, when it already licenses the Twitter "firehose" for its new artificial intelligence platform, Einstein.

At Salesforce's annual client conference last week, Benioff said Salesforce considers buying many companies but maintains discipline, and wished Twitter CEO Jack Dorsey "well." These comments tamped out expectations that Salesforce would be an aggressive bidder for Twitter.

Since its founding a decade ago, Twitter has struggled to generate revenue growth and profit, despite having some 313 million average monthly active users and a growing presence as a source of news.

========================================

CRM

10/10 CLOSE: UP 4.19/share to 75.10/share

EPS: 0.318

P/E: 228.476

BETA: 1.589

--------

Earnings per share (EPS) is the portion of a company's profit allocated to each outstanding share of common stock. Earnings per share serves as an indicator of a company's profitability.

Calculated as:

------

The price to earnings ratio (PE Ratio) is the measure of the share price relative to the annual net income earned by the firm per share. PE ratio shows current investor demand for a company share. A high PE ratio generally indicates increased demand because investors anticipate earnings growth in the future. The PE ratio has units of years, which can be interpreted as the number of years of earnings to pay back purchase price.

PE ratio is often referred to as the "multiple" because it demonstrates how much an investor is willing to pay for one dollar of earnings. PE Ratios are sometimes calculated using estimations of next year's earnings per share in the denominator. When this happens, it is usually noted.

For more information on evaluating valuation multiples similar to this, please see our original white paper research : Making Sense Of Valuation Multiples.

Formula

Price to Earnings Ratio = Price / Earnings Per Share (EPS)

(Note: YCharts uses the Trailing Twelve Months (TTM) sum of Net EPS Diluted in the denominator)

------

A beta of 1 indicates that the security's price moves with the market. A beta of less than 1 means that the security is theoretically less volatile than the market. A beta of greater than 1 indicates that the security's price is theoretically more volatile than the market. For example, if a stock's beta is 1.2, it's theoretically 20% more volatile than the market. Conversely, if an ETF's beta is 0.65, it is theoretically 35% less volatile than the market. Therefore, the fund's excess return is expected to underperform the benchmark by 35% in up markets and outperform by 35% during down markets.

Last edited:

Verizon closing call centers in five U.S. states, 3,200 jobs affected

50.29USD Price decrease 0.01 (0.02%)

56.53USD 52 week high

(may be a ~head & shoulders pattern with last shoulder forming (time will tell))

Verizon Communications Inc (VZ.N) said on Thursday it plans to close call centers in five states, including its home state of New York, as the No. 1 wireless company trims head count and reorganizes operations in a saturated wireless market.

The move, which will affect 3,200 workers is a part of Verizon's effort to consolidate customer service operations across the United States.

The company, which has a workforce of about 162,700, recently agreed to buy Yahoo Inc (YHOO.O) for $4.8 billion as it looks to tap new revenue in areas such as digital media and advertising.

"We are realigning our real estate portfolio and relocating these centers into other centers where we have extra capacity," Verizon spokeswoman Kim Ancin said.

Verizon is offering affected employees jobs in call centers in other states, she said.

The consolidation involves Verizon call centers near Rochester and Orangeburg, New York; Bangor, Maine; Lincoln, Nebraska; Wallingford and Meriden, Connecticut; and Rancho Cordoba, California, the company said.

The proposed call center closures, which will impact 850 jobs in New York, drew a testy response from the office of New York's governor, Andrew Cuomo.

"This is an egregious example of corporate abuse – among the worst we have witnessed during the six years of this administration," Rich Azzopardi, a spokesman for the governor, said in a statement. Verizon's call center closures will result in job losses for "hard-working" New Yorkers, he added.

Employees who choose to move to other call centers, which handle sales and billing and help customers with technical problems, will be given relocation packages starting at $10,000, Ancin said. Those who leave the company will be given a severance package, outplacement resources and other support.

In April, nearly 40,000 employees of the wireline business, which includes FiOS Internet, telephone and TV services, represented by unions, went on strike after reaching an impasse in talks over a new labor contract. Sticking points included the relocation of employees and offshoring of call center jobs.

The strike, which was one of the largest in recent years in the United States, drew support from Democratic U.S. Presidential candidate Hillary Clinton. A new deal was reached in May and striking wireline employees got back to work in June.

The Verizon wireless call center closures in five states involve employees who are NOT represented by unions, Ancin said.

(Reporting by Malathi Nayak in New York and Aishwarya Venugopal in Bengaluru; Editing by Martina D'Couto, Bill Trott and David Gregorio)

50.29USD Price decrease 0.01 (0.02%)

56.53USD 52 week high

(may be a ~head & shoulders pattern with last shoulder forming (time will tell))

Verizon Communications Inc (VZ.N) said on Thursday it plans to close call centers in five states, including its home state of New York, as the No. 1 wireless company trims head count and reorganizes operations in a saturated wireless market.

The move, which will affect 3,200 workers is a part of Verizon's effort to consolidate customer service operations across the United States.

The company, which has a workforce of about 162,700, recently agreed to buy Yahoo Inc (YHOO.O) for $4.8 billion as it looks to tap new revenue in areas such as digital media and advertising.

"We are realigning our real estate portfolio and relocating these centers into other centers where we have extra capacity," Verizon spokeswoman Kim Ancin said.

Verizon is offering affected employees jobs in call centers in other states, she said.

The consolidation involves Verizon call centers near Rochester and Orangeburg, New York; Bangor, Maine; Lincoln, Nebraska; Wallingford and Meriden, Connecticut; and Rancho Cordoba, California, the company said.

The proposed call center closures, which will impact 850 jobs in New York, drew a testy response from the office of New York's governor, Andrew Cuomo.

"This is an egregious example of corporate abuse – among the worst we have witnessed during the six years of this administration," Rich Azzopardi, a spokesman for the governor, said in a statement. Verizon's call center closures will result in job losses for "hard-working" New Yorkers, he added.

Employees who choose to move to other call centers, which handle sales and billing and help customers with technical problems, will be given relocation packages starting at $10,000, Ancin said. Those who leave the company will be given a severance package, outplacement resources and other support.

In April, nearly 40,000 employees of the wireline business, which includes FiOS Internet, telephone and TV services, represented by unions, went on strike after reaching an impasse in talks over a new labor contract. Sticking points included the relocation of employees and offshoring of call center jobs.

The strike, which was one of the largest in recent years in the United States, drew support from Democratic U.S. Presidential candidate Hillary Clinton. A new deal was reached in May and striking wireline employees got back to work in June.

The Verizon wireless call center closures in five states involve employees who are NOT represented by unions, Ancin said.

(Reporting by Malathi Nayak in New York and Aishwarya Venugopal in Bengaluru; Editing by Martina D'Couto, Bill Trott and David Gregorio)

Last edited:

Twitter Planning Hundreds More Job Cuts as Soon as This Week

Twitter Inc., having failed to sell itself, is planning to fire about 8 percent of its workforce as the struggling social-media company prepares to go it alone for the time being.

Twitter may eliminate about 300 people, the same percentage it did last year when co-founder Jack Dorsey took over as chief executive officer, according to people familiar with the matter. Planning for the cuts is still fluid and the number could change, they added. The people asked not to be identified talking about private company plans.

An announcement about the job reductions may come before Twitter releases third-quarter earnings on Thursday, one of the people said. A Twitter representative declined to comment.

Twitter, which is unprofitable, is trying to control spending as sales growth slows. The company recently hired bankers to explore a sale, but the companies that had expressed interest in bidding -- Salesforce.com Inc., The Walt Disney Co. and Alphabet Inc. -- later backed out from the process.

The job cuts suggest Twitter isn’t in a position to beat analysts’ estimates for results in the third quarter or its outlook for the fourth, Loop Capital analyst Blake Harper wrote in a note to clients. He rates the stock hold.

Twitter shares fell as much as 4.9 percent Tuesday. They were down 4.2 percent to $17.28 at 11:16 a.m. in New York.

Twitter’s losses and 40 percent fall in its share price the past 12 months have made it more difficult for the company to pay its engineers with stock. That has made it harder for Twitter to compete for talent with giant rivals like Alphabet Inc.’s Google and Facebook Inc. Reducing employee numbers would relieve some of this pressure.

Twitter Inc., having failed to sell itself, is planning to fire about 8 percent of its workforce as the struggling social-media company prepares to go it alone for the time being.

Twitter may eliminate about 300 people, the same percentage it did last year when co-founder Jack Dorsey took over as chief executive officer, according to people familiar with the matter. Planning for the cuts is still fluid and the number could change, they added. The people asked not to be identified talking about private company plans.

An announcement about the job reductions may come before Twitter releases third-quarter earnings on Thursday, one of the people said. A Twitter representative declined to comment.

Twitter, which is unprofitable, is trying to control spending as sales growth slows. The company recently hired bankers to explore a sale, but the companies that had expressed interest in bidding -- Salesforce.com Inc., The Walt Disney Co. and Alphabet Inc. -- later backed out from the process.

The job cuts suggest Twitter isn’t in a position to beat analysts’ estimates for results in the third quarter or its outlook for the fourth, Loop Capital analyst Blake Harper wrote in a note to clients. He rates the stock hold.

Twitter shares fell as much as 4.9 percent Tuesday. They were down 4.2 percent to $17.28 at 11:16 a.m. in New York.

Twitter’s losses and 40 percent fall in its share price the past 12 months have made it more difficult for the company to pay its engineers with stock. That has made it harder for Twitter to compete for talent with giant rivals like Alphabet Inc.’s Google and Facebook Inc. Reducing employee numbers would relieve some of this pressure.

What do you think about Tmobile stock?

+ EPS 1.5995

+ P/E 37.794

+ Beta .77169

+ Potential Buyout Target

+/- Millions of shares traded daily

- No Dividend (if looking short term this is not a problem)

Unknowns:

Will there be a buyout?

Grew 2 million customers, but is the customer growth potential still there?

Opinion:

If I was to buy TMUS, it would be all about chart timing for me, on a short term buy, hold, sell, utilizing a trailing stop.

I would prefer to have VZ in my portfolio over T-Mobile, if I was to buy a cellular company.

===============

TRAILING STOP

WHAT IT IS:

A trailing stop is a special type of trade order where the stop-loss price is not set at a single, absolute dollar amount, but instead is set at a certain percentage or a certain dollar amount below the market price.

When the price goes up, it drags the trailing stop along with it, but when the price stops going up, the stop-loss price remains at the level it was dragged to.

A trailing stop is a way to automatically protect yourself from an investment's downside while locking in the upside.

A trailing stop is sometime referred to as a trailing stop-loss.

HOW IT WORKS (EXAMPLE):

For example, you buy Company XYZ for $10. You decide that you don't want to lose more than 5% on your investment, but you want to be able to take advantage of any price increases. You also don't want to have to constantly monitor your trades to lock in gains.

You set a trailing stop on XYZ that orders your broker to automatically sell if the price dips more than 5% below the market price.

The benefits of the trailing stop are two-fold. First, if the stock moves against you, the trailing stop will trigger when XYZ hits $9.50, protecting you from futher downside.

But if the stock goes up to $20, the trigger price for the trailing stop comes up along with it. At a price of $20, the trailing stop will only trigger a sale if the stock drops below $19. This helps you lock in most of the gains from the stock's rally.

In the example, you could also decide you don't want to lose more than $2 on your $10 investment. If the stock goes up to $20, the trailing stop would drag along behind the price and only trigger if the stock falls to $18.

WHY IT MATTERS:

A trailing stop can be good for investors who may not have enough discipline to lock-in gains or cut losses. It removes some of the emotion from the trading process and offers some capital protection automatically.

There are some drawbacks to consider. First, you need to consider your trailing stop percentage or amount very carefully. If you're investing in a particularly volatile stock, you could find the stop level triggered fairly frequently.

Second, frequent trading can have tax implications such as "wash sales" for stock held less than 30 days.

Finally, excessive trading can quickly turn into "churning," with fees and commissions eating into your profits.

Last edited:

Moving Averages: How To Use Them

By Casey Murphy, Senior Analyst ChartAdvisor.com

Some of the primary functions of a moving average are to identify trends and reversals, measure the strength of an asset's momentum and determine potential areas where an asset will find support or resistance. In this section we will point out how different time periods can monitor momentum and how moving averages can be beneficial in setting stop-losses. Furthermore, we will address some of the capabilities and limitations of moving averages that one should consider when using them as part of a trading routine.

Trend

Identifying trends is one of the key functions of moving averages, which are used by most traders who seek to "make the trend their friend". Moving averages are lagging indicators, which means that they do not predict new trends, but confirm trends once they have been established. As you can see in Figure 1, a stock is deemed to be in an uptrend when the price is above a moving average and the average is sloping upward. Conversely, a trader will use a price below a downward sloping average to confirm a downtrend. Many traders will only consider holding a long position in an asset when the price is trading above a moving average. This simple rule can help ensure that the trend works in the traders' favor.

Figure 1

Momentum

Many beginner traders ask how it is possible to measure momentum and how moving averages can be used to tackle such a feat. The simple answer is to pay close attention to the time periods used in creating the average, as each time period can provide valuable insight into different types of momentum. In general, short-term momentum can be gauged by looking at moving averages that focus on time periods of 20 days or less. Looking at moving averages that are created with a period of 20 to 100 days is generally regarded as a good measure of medium-term momentum. Finally, any moving average that uses 100 days or more in the calculation can be used as a measure of long-term momentum. Common sense should tell you that a 15-day moving average is a more appropriate measure of short-term momentum than a 200-day moving average.

One of the best methods to determine the strength and direction of an asset's momentum is to place three moving averages onto a chart and then pay close attention to how they stack up in relation to one another. The three moving averages that are generally used have varying time frames in an attempt to represent short-term, medium-term and long-term price movements. In Figure 2, strong upward momentum is seen when shorter-term averages are located above longer-term averages and the two averages are diverging. Conversely, when the shorter-term averages are located below the longer-term averages, the momentum is in the downward direction.

Figure 2

Support

Another common use of moving averages is in determining potential price supports. It does not take much experience in dealing with moving averages to notice that the falling price of an asset will often stop and reverse direction at the same level as an important average. For example, in Figure 3 you can see that the 200-day moving average was able to prop up the price of the stock after it fell from its high near $32. Many traders will anticipate a bounce off of major moving averages and will use other technical indicators as confirmation of the expected move.

Figure 3

Resistance

Once the price of an asset falls below an influential level of support, such as the 200-day moving average, it is not uncommon to see the average act as a strong barrier that prevents investors from pushing the price back above that average. As you can see from the chart below, this resistance is often used by traders as a sign to take profits or to close out any existing long positions. Many short sellers will also use these averages as entry points because the price often bounces off the resistance and continues its move lower. If you are an investor who is holding a long position in an asset that is trading below major moving averages, it may be in your best interest to watch these levels closely because they can greatly affect the value of your investment.

Figure 4

Stop-Losses

The support and resistance characteristics of moving averages make them a great tool for managing risk. The ability of moving averages to identify strategic places to set stop-loss orders allows traders to cut off losing positions before they can grow any larger. As you can see in Figure 5, traders who hold a long position in a stock and set their stop-loss orders below influential averages can save themselves a lot of money. Using moving averages to set stop-loss orders is key to any successful trading strategy.

Figure 5

NEXT

Moving Averages: Factors To Consider

By Casey Murphy, Senior Analyst ChartAdvisor.com

Some of the primary functions of a moving average are to identify trends and reversals, measure the strength of an asset's momentum and determine potential areas where an asset will find support or resistance. In this section we will point out how different time periods can monitor momentum and how moving averages can be beneficial in setting stop-losses. Furthermore, we will address some of the capabilities and limitations of moving averages that one should consider when using them as part of a trading routine.

Trend

Identifying trends is one of the key functions of moving averages, which are used by most traders who seek to "make the trend their friend". Moving averages are lagging indicators, which means that they do not predict new trends, but confirm trends once they have been established. As you can see in Figure 1, a stock is deemed to be in an uptrend when the price is above a moving average and the average is sloping upward. Conversely, a trader will use a price below a downward sloping average to confirm a downtrend. Many traders will only consider holding a long position in an asset when the price is trading above a moving average. This simple rule can help ensure that the trend works in the traders' favor.

Figure 1

Momentum

Many beginner traders ask how it is possible to measure momentum and how moving averages can be used to tackle such a feat. The simple answer is to pay close attention to the time periods used in creating the average, as each time period can provide valuable insight into different types of momentum. In general, short-term momentum can be gauged by looking at moving averages that focus on time periods of 20 days or less. Looking at moving averages that are created with a period of 20 to 100 days is generally regarded as a good measure of medium-term momentum. Finally, any moving average that uses 100 days or more in the calculation can be used as a measure of long-term momentum. Common sense should tell you that a 15-day moving average is a more appropriate measure of short-term momentum than a 200-day moving average.

One of the best methods to determine the strength and direction of an asset's momentum is to place three moving averages onto a chart and then pay close attention to how they stack up in relation to one another. The three moving averages that are generally used have varying time frames in an attempt to represent short-term, medium-term and long-term price movements. In Figure 2, strong upward momentum is seen when shorter-term averages are located above longer-term averages and the two averages are diverging. Conversely, when the shorter-term averages are located below the longer-term averages, the momentum is in the downward direction.

Figure 2

Support

Another common use of moving averages is in determining potential price supports. It does not take much experience in dealing with moving averages to notice that the falling price of an asset will often stop and reverse direction at the same level as an important average. For example, in Figure 3 you can see that the 200-day moving average was able to prop up the price of the stock after it fell from its high near $32. Many traders will anticipate a bounce off of major moving averages and will use other technical indicators as confirmation of the expected move.

Figure 3

Resistance

Once the price of an asset falls below an influential level of support, such as the 200-day moving average, it is not uncommon to see the average act as a strong barrier that prevents investors from pushing the price back above that average. As you can see from the chart below, this resistance is often used by traders as a sign to take profits or to close out any existing long positions. Many short sellers will also use these averages as entry points because the price often bounces off the resistance and continues its move lower. If you are an investor who is holding a long position in an asset that is trading below major moving averages, it may be in your best interest to watch these levels closely because they can greatly affect the value of your investment.

Figure 4

Stop-Losses

The support and resistance characteristics of moving averages make them a great tool for managing risk. The ability of moving averages to identify strategic places to set stop-loss orders allows traders to cut off losing positions before they can grow any larger. As you can see in Figure 5, traders who hold a long position in a stock and set their stop-loss orders below influential averages can save themselves a lot of money. Using moving averages to set stop-loss orders is key to any successful trading strategy.

Figure 5

NEXT

Moving Averages: Factors To Consider

Venezuela Caps Daily Bank Withdrawals at US$5 to Avoid Bankruptcy

Venezuela has put a cap on daily bank withdrawals at VEF $10,000, or US $5.26.

The Superintendency of Banking Sector Institutions (Sudeban) ordered public and private banks to refrain from paying out more than US $ 5.26 per day in cash from offices or ATMs.

Users have reportedly expressed frustration at trying to withdrawal money since Novemeber 15 with checks or through cashiers.

According to a statement released by Sudeban, users can make a maximum of four transactions per day to withdraw up to US $5.

The decision was made as Venezuela suffers from rampant inflation exceeding 750 percent, which has forced many citizens to handle more cash for their purchases.

Venezuelans took to social media to express their concern about the strange financial decision made by their government, calling it a “financial corralito.”

CORRALITO… Up to 10.000 VEB can be withdrawn from banks and ATMs in Venezuela

A financial corralito is a government’s attempt to avoid bankrupting its banking system in times of economic recession, and when confidence in that system has noticeably declined. When people begin to distrust the system, they withdraw all of their savings in cash.

No Bills

The delivery of bank notes to various public and private banking agencies has reportedly fallen by an average of 50 percent in the last month.

According to sources linked to the Central Bank of Venezuela, the new banknotes will enter into circulation on December 15, but will do so through a gradual process. Two-hundred bolivar notes (USD $ 0.10) and 500 bolivars (USD $ 0.25) will be released first and then 1,000 bolivar notes (USD $ 0.50), followed by 5,000 (USD $ 2,63), 10,000 (USD $ 5,2) and 20,000 bolivares (USD $ 10.50) notes.

Source: El Nacional

=========================================

Venezuela has put a cap on daily bank withdrawals at VEF $10,000, or US $5.26.

The Superintendency of Banking Sector Institutions (Sudeban) ordered public and private banks to refrain from paying out more than US $ 5.26 per day in cash from offices or ATMs.

Users have reportedly expressed frustration at trying to withdrawal money since Novemeber 15 with checks or through cashiers.

According to a statement released by Sudeban, users can make a maximum of four transactions per day to withdraw up to US $5.

The decision was made as Venezuela suffers from rampant inflation exceeding 750 percent, which has forced many citizens to handle more cash for their purchases.

Venezuelans took to social media to express their concern about the strange financial decision made by their government, calling it a “financial corralito.”

CORRALITO… Up to 10.000 VEB can be withdrawn from banks and ATMs in Venezuela

A financial corralito is a government’s attempt to avoid bankrupting its banking system in times of economic recession, and when confidence in that system has noticeably declined. When people begin to distrust the system, they withdraw all of their savings in cash.

No Bills

The delivery of bank notes to various public and private banking agencies has reportedly fallen by an average of 50 percent in the last month.

According to sources linked to the Central Bank of Venezuela, the new banknotes will enter into circulation on December 15, but will do so through a gradual process. Two-hundred bolivar notes (USD $ 0.10) and 500 bolivars (USD $ 0.25) will be released first and then 1,000 bolivar notes (USD $ 0.50), followed by 5,000 (USD $ 2,63), 10,000 (USD $ 5,2) and 20,000 bolivares (USD $ 10.50) notes.

Source: El Nacional

=========================================

Last edited:

Where's my correction?

Need to jump back in.

Need to jump back in.

What should I be looking at??? The main stocks I have now is nvda, goog, tsla, amzn and fb. I have a bunch of other random shit but those are my big plays.

With Trump in office, the play is Financials and Healthcare.

Corp earnings could go up as much as 18% next year if Trump can pull off some level of tax reform. With interest rates going up, it could impact valuations (P/Es); however, it still should help continue growth in the stock market.

Fed will likely def pop the short-term rates in December (LIBOR and Prime are tied to Fed Funds which is what the Fed controls) and probably see another 50-75bps in 2017 - which will do wonders for Bank earnings - assuming the Banks are asset sensitive - which most are. This assumes the long-term rates (10yr T-Bills, etc) keep going up. If not, we may only see modest action from the Fed in fear of an inverted yield curve which is always precedent to a recession.

Hilary cant price regulate any new drugs or medical break throughts - along with a repeal of Obamacare - should help the Healthcare stocks.

It is great news with Trump in office along with a Republican controlled House and Senate.

Corp earnings could go up as much as 18% next year if Trump can pull off some level of tax reform. With interest rates going up, it could impact valuations (P/Es); however, it still should help continue growth in the stock market.

Fed will likely def pop the short-term rates in December (LIBOR and Prime are tied to Fed Funds which is what the Fed controls) and probably see another 50-75bps in 2017 - which will do wonders for Bank earnings - assuming the Banks are asset sensitive - which most are. This assumes the long-term rates (10yr T-Bills, etc) keep going up. If not, we may only see modest action from the Fed in fear of an inverted yield curve which is always precedent to a recession.

Hilary cant price regulate any new drugs or medical break throughts - along with a repeal of Obamacare - should help the Healthcare stocks.

It is great news with Trump in office along with a Republican controlled House and Senate.

Props:

phncke and phncke

I cashed out roughly 2/3 the week of election. Had 270 shares of nvda and misssed the 30% jump. Made me sick. Also got my ass kicked playing with gold, haven't sold it, but obviously lost value

What should I be looking at??? The main stocks I have now is nvda, goog, tsla, amzn and fb. I have a bunch of other random shit but those are my big plays.

What should I be looking at??? The main stocks I have now is nvda, goog, tsla, amzn and fb. I have a bunch of other random shit but those are my big plays.

I can't really tell you what to buy, other than you really need to diversify. You are pretty much 100% tech.

Only tech I'm watching right now is INTC and WDC.

Both are too high for me right now.

Props:

phncke and phncke

Potential shorts:

CUZ

HWCC

SBNY

LORL

PLSE

GE

I am long:

INTC (predict earnings beat in Jan, will cash out at $38-$40)

GILD (predict next earnings report will lead to $4-8 jump beyond what price is then)

PINC (waiting for $34)

Potential Buys:

HRL

TSN

CMG (waiting for bottom to get in and out)

WY

MC

Also watching:

EYEG (-EPS though) as a wildcard

RCI

AJRD

AIQ

COMM

AXP

SHOO

GEL

NKE

MYL

BMY

KTCC

ARII

CUZ

HWCC

SBNY

LORL

PLSE

GE

I am long:

INTC (predict earnings beat in Jan, will cash out at $38-$40)

GILD (predict next earnings report will lead to $4-8 jump beyond what price is then)

PINC (waiting for $34)

Potential Buys:

HRL

TSN

CMG (waiting for bottom to get in and out)

WY

MC

Also watching:

EYEG (-EPS though) as a wildcard

RCI

AJRD

AIQ

COMM

AXP

SHOO

GEL

NKE

MYL

BMY

KTCC

ARII

Props:

phncke and phncke

That's a pretty heavy load on tech. You could technically consider TSLA a tech play as well, at least it leans that way compared to F and GM.

I can't really tell you what to buy, other than you really need to diversify. You are pretty much 100% tech.

Only tech I'm watching right now is INTC and WDC.

Both are too high for me right now.

I can't really tell you what to buy, other than you really need to diversify. You are pretty much 100% tech.

Only tech I'm watching right now is INTC and WDC.

Both are too high for me right now.

On another note I just went big$(for me) into a development in phoenix of condo storage units.

Potential shorts:

AXP

BMY

AXP

BMY

Totally agree with BMY. Oversold. I'm watching it as well.

On another note I just went big$(for me) into a development in phoenix of condo storage units.

Biggest draw backs are being 24\7 and security, but I hope you make a killing!